Does Renters Insurance Cover Flood Damage To Personal Property

Renters insurance will generally cover the damages to your possessions if ice buildup atop the roof leads to water damages within the building. If a person is.

What Is Personal Liability Coverage For Renters Insurance

Some of the most common perils not covered by renters insurance include floods and earthquakes.

Does renters insurance cover flood damage to personal property. Contact Your Renters Insurance Company Aside from contacting your landlord calling the police if appropriate and safeguarding your property one of the first things you need to do is contact your renters insurance company immediately after property damage or loss. Suppose items you own are damaged by wind from a hurricane or tornado for instance. The personal property coverage in a renters insurance policy helps cover belongings from certain risks often described as perilsA renters insurance policy may help pay for damage caused by perils such as.

If your washing machine were to leak and destroy your personal property a standard renters insurance policy would likely be covered under your renters insurance policy. Renters insurance is fairly inexpensive compared to homeowners insurance policies. Even without a flood insurance policy having a renters insurance in place can save your finances in the event of a disaster.

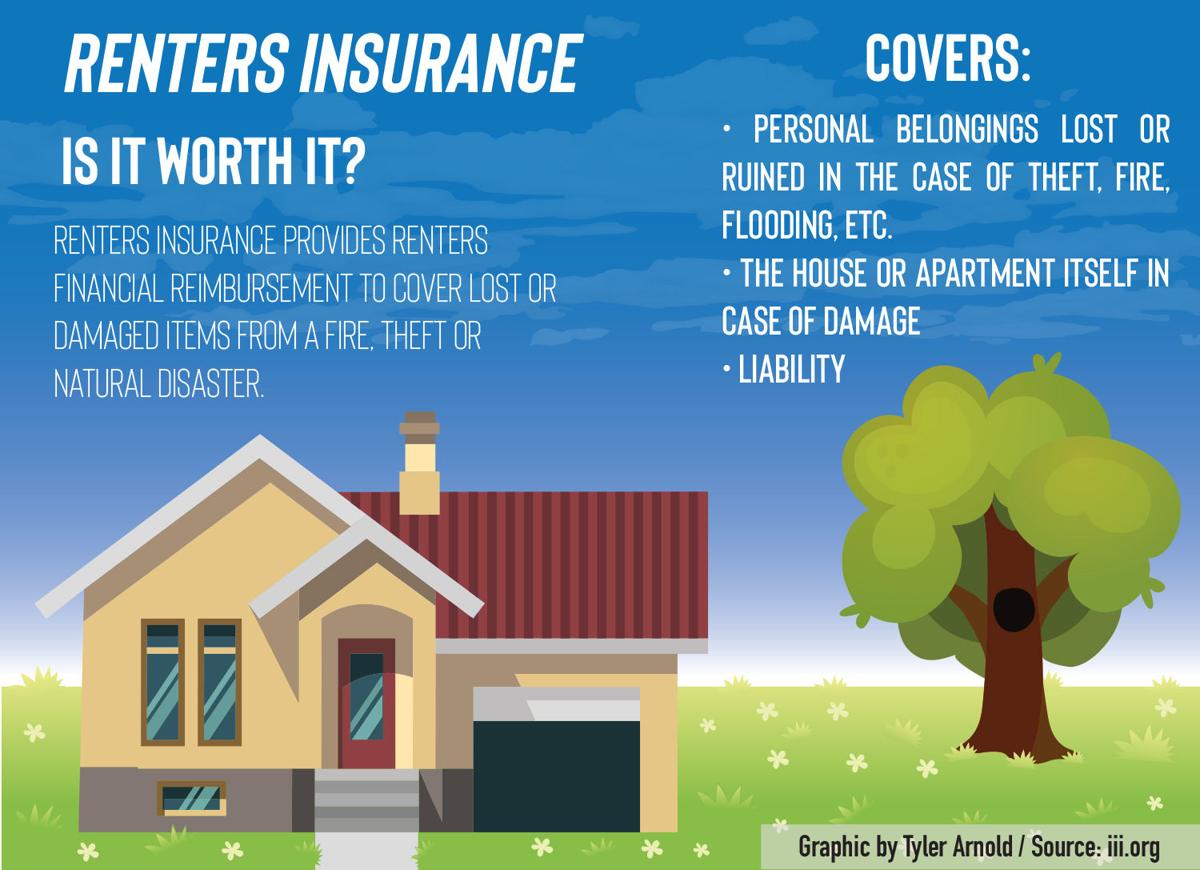

While homeowners insurance is designed to cover the propertys structure as well as the possessions within renters insurance only includes protection for your belongings not the building itself your landlords policy covers that. Standard renters insurance does not however cover all natural disasters. Yes renters can get flood insurance through a private insurer or the federal emergency management agencys fema national flood insurance programYes your personal property damage is covered by your renters insurance policyYou can purchase federal flood insurance or obtain it.

Even minor floods can cause a lot of damage. In contrast with real property damage which is covered by the liability portion of your renters insurance policy your renters insurance policy is designed to protect your personal property. Renters insurance only covers damage to the policyholders personal property and damage they accidentally cause to someone elses property including a house or belongings.

Building damage falls to landlords to cover the costs. When damage or theft of your personal property is covered by your renters insurance you can make a claim for reimbursement up to your policy limits. So if a pipe freezes and bursts during the winter and it damages some of your possessions you can file a claim on them.

Most renters insurance does not cover floods or flood damage. When does renters insurance cover flood damage. Water damage is also commonly named in renters insurance policy but coverage only goes so far.

When it comes to flood damage as a specific cause of loss renters insurance does. Yes your personal property damage is covered by your renters insurance policy. This particular coverage also extends to frozen pipes within the home.

For example water damage caused to your belongings by a burst pipe may be covered under a renters insurance policy but damage caused to the same belongings by the overflow of a nearby body of. Although standard renters insurance policies cover some forms of water damage to your personal property renters insurance does not cover flood damage to your belongings due to weather. Does renters insurance cover personal property damage.

Personal property that is damaged can be claimed on the policy as long as it falls under covered peril. Flood insurance is one of those things you pay for hoping youll never need to use. The policies change with various insurance companies but there are some similarities found below.

To be covered the property damage must have been caused by a covered peril. Because flood damage is so pervasive and expensive damage from floods is one thing that renters insurance explicitly doesnt cover. And adding a flood insurance policy to your existing insurance.

Talk to an independent agent about flood insurance and how much coverage you need to guarantee your personal property is protected. For one thing youll want to find out if your loss is covered. The only way to protect yourself and your belongings is an insurance policy that explicitly covers floods.

Generally speaking it does not. Renters insurance does not cover the actual structure where the tenant lives. Your renters insurance doesnt cover your stuff in a flood.

Typical exceptions include earthquakes and floods in which case you will need to purchase additional coverage if necessary. Renters insurance doesnt cover damage caused by external flooding but can cover internal water damage even if weather-related. The property owner has or should have homeowners insurance which covers damage to the property and its improvements.

If there is a flood your landlord has no obligation to pay for personal property damage. For example water damage caused to your belongings by a burst pipe may be covered under a renters insurance policy but damage caused to the same belongings by the overflow of a nearby body of. What types of flood damage does renters insurance not cover.

THE SIMPLY INSURANCE WAY. Improvements means any buildings or permanent structures on the property Renters insuranc. Weight of ice snow or sleet.

While having a renters insurance policy can certainly protect you from many different scenarios flood damage isnt normally covered. Although standard renters insurance policies cover some forms of water damage to your personal property renters insurance does not cover flood damage to your belongings due to weather. However you do receive liability coverage and additional living expenses for claims that require it.

What Does Renters Insurance Cover If You Have Been Looking For The Answer To What Does Renters Insuran Renters Insurance Rental Insurance Insurance Marketing

Home And House Insurance In South Florida Fic Insurance Homeowners Insurance Home Insurance Best Homeowners Insurance

Protect Yourself And Your Property With Renters Insurance Aaa Com Insurance Renters Insurance Renter Bodily Injury

What Does Renters Insurance Cover 7 Surprising Things Real Estate 101 Trulia Blog

Professionals Stress Importance Of Having Renters Insurance News Dailytoreador Com

Renters Insurance Is A Must Have Guide To Renters Insurance Renters Insurance Rental Insurance Tenant Insurance

13 Faqs About Renters Insurance Damage Coverage Mig Insurance

Why You Should Encourage Your Kids To Get Renters Insurance Thoroughly Modern Gillie Renters Insurance Dental Insurance Renter

Renters Insurance In A Nutshell Renters Insurance Tenant Insurance Insurance Marketing

Does Renters Insurance Cover Water Damage Valuepenguin

Renters Insurance Myths Busted Renters Insurance Homeowners Insurance Landlord Insurance

Personal Property Insurance What You Should Know Insuropedia By Lemonade

What Does Renters Insurance Cover And How To File A Claim In 6 Easy Steps Plain Finances Renters Insurance Home Insurance Quotes Renter

Find The Best Renters Insurance Policy For 2021 Best Renters Insurance Renters Insurance Insurance Policy

Plain Finances Renters Insurance Renter Personal Insurance

Pin By Commonwealth Insurance Center On All About Renters Insurance Renters Insurance House Rental Personal Property

Is Renters Insurance Worth It What It Covers And What It Doesn T Avail

Here Is The Ultimate Guide To Renters Insurance Policies With Quotes And Coverage Options For Colleg Renters Insurance Best Renters Insurance College Students

Post a Comment for "Does Renters Insurance Cover Flood Damage To Personal Property"